Yes, Backblaze was days away from being acquired—and then everything fell apart.

In this post, I’ll share why I’m publicly sharing this, exactly what happened, the details of our acquisition process, how we are moving forward, and what we learned.

Why Am I Sharing This?

When all of this ended, a couple of our advisors said, “That really sucks, but I wanted to let you know that something like this happened to me in a past company as well.”

Our team has been through a few acquisitions and this had never happened to us. In fact, I had never heard of this happening before. But it does. And probably not as infrequently as one might guess.

So, why share this?

- Because we’re an open company by nature.

- Because hopefully for the people and companies to whom this happens, it’s a bit of a public, “That really sucks, but I wanted to let you know that you’re not alone…”

- Because for companies going into such a process, I hope this can shed some light and some lessons learned.

How Backblaze Started

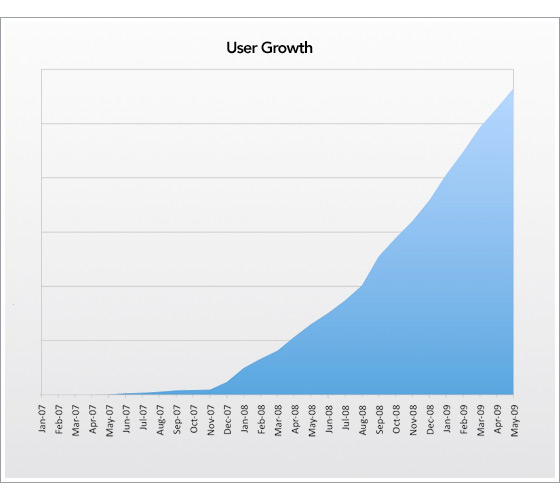

After seeing a friend tortured by having lost data, we asked others, “What do you do to ensure you don’t lose your photos, music, or documents?” The answer was consistent: “Nothing.” We knew other solutions existed, but people didn’t back up, so we brainstormed a really easy online backup service and Backblaze was born.

We wanted to build a successful, profitable company that customers loved—and did not want to risk being forced to “exit.” Thus, we chose up front not to raise VC funding. We wanted be able to take the company public, be acquired, or run it forever—whatever ended up being best for the team, our customers, and our partners.

How We Got the First Offer

First? Yes, first. We received a second offer shortly after the first.

As we grew Backblaze, we talked to lots of people about various types of partnerships. Many of these came to fruition as we signed up niche newsletters, IT consultants, schools, etc.

One of these partnership discussions was with a large company. Let’s call them Spacely Space Sprockets Software, or Spacely for short. I met one of Spacely’s people over a year ago at a party and we chatted briefly about ways we could work together. We lost touch and six months later we got reconnected by a mutual friend and started discussing ideas again. We held a number of meetings with additional key people present from both companies and further discussed ways of partnering, technology, integration options, etc.

Our initial discussions focused on our affiliate program, which is a light partnership where we handle the billing and support. However, as we dug deeper, Spacely got very excited about our innovative cloud storage and the joint opportunity and asked us, “Would you be open to being acquired?”

We said that, in principle, we would be open, but it would depend on the offer. In addition to the financials, it was important to us that we continue to execute our vision of helping everyone back up their data with an easy-to-use, back-up-everything service. We wanted to keep supporting our customers. And from experience, we wanted to keep our team together to ensure we could continue to execute.

Within about two weeks they sent over a written term sheet.

Evaluating the Offer

After Spacely expressed interest in acquiring Backblaze, before we received the written offer, we discussed internally whether we wanted to reach out to other companies to see if anyone else would like to make an offer. We decided there could be three scenarios:

1. Spacely makes a low offer that we would not accept.

We would work with Spacely to see if they could get to an offer that we would accept.

2. Spacely makes an okay offer we would consider, but would not be thrilled with.

We would reach out to other companies to see if they were interested as well.

3. Spacely makes a good offer that we would be quite happy with.

We would sign the offer letter. We called this our “Buy Now” price.

There are plenty of subtleties that we realized would matter in addition to price: how the deal was structured, what would happen to the business itself, what the timeframes looked like, etc. By the time we went through the process we learned just how many other things mattered that we didn’t consider upfront.

The Offer Itself

When we received the offer, it initially fell into Scenario One (too low for us to consider), but after a few discussions moved to Scenario Two (an offer we would consider, but certainly not one we were ready to simply accept).

We felt we had good vision alignment with Spacely. We liked their people and felt like we had a shared approach to business and product development. The financial aspects of the offer were structured in multiple pieces:

- Upfront payment

- Escrow payment (held in case of lawsuits)

- Earn out payment (paid for hitting milestones)

However, there were a number of more subtle items to discuss:

- How long is the “lockup?” (Time in which Backblaze can’t talk to other potential acquirers.)

- How do you define/measure the goals to hit the earn out?

- Who is liable for what risks?

We started working through these items—trying to make the right tradeoffs:

- Which items need resolution before signing the offer vs. closing the deal?

- Which items do we really care about?

- How long do we want to spend on any given item?

Getting the Second Offer

Since this offer fell into Scenario 2, we also decided that we should talk to a few other companies to see if they would be interested in making an offer as well. Here, I want to thank Tim Eades, who was a tremendous help in making introductions, providing advice, and acting as a sounding board. Thank you also to Ed Bugnion and Keval Desai who provided both guidance and introductions to other companies.

We started by brainstorming a fairly comprehensive list of companies that could be potential acquirers. Then we whittled down the list to those that seemed like they should be a natural fit, could potentially move quickly, and where we had solid executive-level contacts.

Spamming every person at every company was not an option as we wanted this process to remain confidential. Thus, we really focused on people we knew would be the ones with the power to make such a decision. Many of these relationships we developed over years prior as we explored various partnership opportunities—which was critical in enabling us to quickly have these discussions.

We reached out to each person and explored whether there was any interest. A few people said, “Hm, interesting. Let’s talk further.” We started engaging with these companies and tried to find the fine balance between “Please move quickly as we will need to make a decision on the other offer” and “Take your time and make an appropriately informed decision.”

There is a natural inclination to say, “We have another offer—do you want to make one? Move quick!” However, almost all experienced executives will simply walk away from this because they are likely too late in the process and do not want to waste their time engaging.

One of the companies—let’s call them Cogswell’s Cosmic Cogs, or Cogswell for short—that we had discussed partnership options with over the last couple of years stepped forward and said, “Yes, we would like to make an offer.”

Negotiating the Two Offers

Cogswell stated they did not want to end up in a negotiation, so we gave guidance on what would be a “Buy Now” offer. When we received their offer, it didn’t make it there, so we started working with Cogswell on an offer we would accept from them over the one we had from Spacely. Of course, we also kept working with Spacely to finalize the various items that would make us feel comfortable signing their offer.

Making the Decision

Finally, it came down to a Tuesday that is deeply etched in my head.

We had offer letters from Spacely and Cogswell that were pretty close to done and both were anxious to sign. The offer from Cogswell was a bit better. However, we were a little further along with Spacely on the terms of the deal. Also, we heard rumors that Cogswell had previous acquisition processes that started and didn’t complete, which made us a bit nervous.

I got our team together and presented the options and it was a tough decision. In the end we decided to go with Spacely because we felt there was more clarity and the advisor’s comment weighed on us. We definitely did not want to spend time and money on a process to have it fizzle out.

However, we asked ourselves—was there a way that our minds could be changed? Yes. We decided clarity on a few specific items, a somewhat higher offer, and a breakup fee that would compensate us for out-of-pocket costs if the deal falls apart would warrant us taking the leap of faith.

At the last minute, around midnight on Tuesday, Cogswell said yes to all of these.

As a double-check I asked, “Are you sure you and your whole team want to do the deal… and do it on these terms, because I don’t want to sign and for you to have buyer’s remorse.” Their answer was an unequivocal, “Yes.”

We Signed the Offer!

Woohoo! Pop the champagne! Well, actually, it was around 2 a.m. at this point, so it was more like “Woohoo, go to bed.” But, with some trepidation about the decision, we were all excited to have signed and to move on to the next step.

In a twist of timing, a few days later, I also got married.

Lest anyone think this is the end of the process, I told our team, “We’re at the half-way point of getting a deal signed.” There was still a lot of work to be done by us and Cogswell before this “intent” would become reality.

Due Diligence

At this point, Cogswell and Backblaze became engaged and it was time to meet each other’s families. We set up a digital data room and placed every relevant document we could think of into it. We filled out questionnaires. Held technical meetings and deep dives. Half day conference calls. Contract reviews. Financial audits.

Six separate outside firms were brought in to pick up every stone, overturn every hard drive, and evaluate every square inch of Backblaze. While we appreciated that the expense they dedicated to these firms showed a level of commitment on Cogswell’s part, we also were a bit concerned that more of the actual firm’s employees were not directly involved.

We consider ourselves a very simple, clean company—and our advisors were all surprised at the amount of due diligence being done. But at the end of it, all was good and we moved forward.

Definitive Agreement

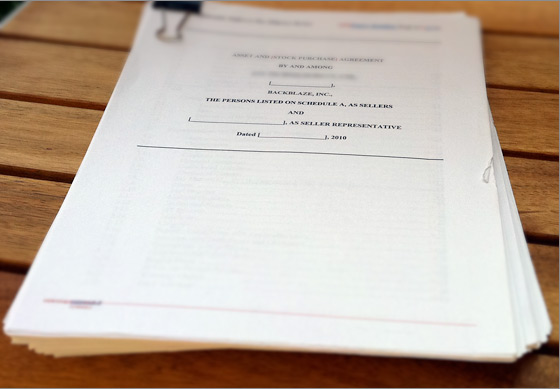

While it seemed like we had nailed down the key terms in the offer letter, it became clear at the definitive agreement stage just how many items were still left open. The Definitive Agreement was a nearly 100-page document broken down into key areas:

- The transaction itself: How much? How is it structured?

- Closing: When? How? And what will be required on the date of closing?

- A ton of legalese: Representations, warranties, covenants and other items where each side says “I commit that the following is the case.”

Negotiating the Definitive Agreement was an ongoing process of figuring out how to balance what the business people wanted on both sides with what the lawyers deemed important.

As part of this, we jointly built out a large business and financial model and associated roadmap items that would be drivers for determining and measuring the earn out.

The due diligence and Definitive Agreement should have taken four weeks. We committed to a six-week quiet period to give everyone the necessary time for completion. When the deal wasn’t going to be finished in six weeks, Cogswell asked us to extend the exclusivity and we agreed to extend it by a week. Then another week. By the third request for an extension, we requested specific milestones to go with extensions and Cogswell agreed. (Realistically, it’s in everyone’s interest to get the deal finished so both companies can start executing against the plan.) Our advisors said, “Wow—that’s a really long time for a company as simple and clean as yours.” But things kept moving forward, slowly; becoming seven, eight, nine, 11, 12 weeks.

We were getting close. Very close. The definitive was nearly done. The various exhibits were almost all final. We had agreed that Backblaze would become an independent unit within the company so that we could keep the team together and execute at full speed. We agreed on the titles and compensation packages for each person. We looked at the office space we would be moving into. Even healthcare and benefits were being set up for the team.

I sent an email to our shareholders saying, “We’re within about a week of signing a definitive agreement. Please let me know if you will not be reachable to sign papers.”

Something Seems Strange

Then the next exclusivity extension was about to expire. I talked with Cogswell on Friday about setting the upcoming week’s milestones in place and planning for the close. They said they were having some issues figuring out the milestone timing.

Saturday. Exclusivity expired.

Warning bells went off. It was possible that Cogswell forgot the exact date of exclusivity expiring and thought they were still under exclusivity. Maybe Cogswell wasn’t worried about it because we were so close? While both were possible, the paranoid senses were saying something was wrong.

The Call

Monday morning I got a call from Cogswell’s CEO. “I’m sooo sorry.”

In summary he said that while he really wanted to make the deal, he couldn’t get all of his board to approve it without restructuring the deal. Would we consider restructuring?

My internal reaction was, “WHAT?!? That’s crazy!”

Deep breath. “I don’t think my team will go for that.”

After having negotiated all of this up front and then spent months finalizing the details, asking for the very basics of the deal to be reconsidered threw a slew of red flags. Since this would be a marriage, it made us fear what other agreements that we are making now would be reconsidered. What would happen six months, a year, a few years after we became one?

Final Discussions

I got my team together for the unpleasant conversation.

The team asked, “What changed?” “Are they just negotiating?” “Why was this not figured out before?” I had no answers, but everyone took it much better than I could have hoped.

The initial response was unanimous. “It’s unfortunate that we wasted so much time on this, but we have a good business, we should not consider restructuring, and we should just walk away.”

I pushed for everyone to sleep on it. We reconvened and decided that while we didn’t understand what happened on their side, we would give them the benefit of the doubt and see if we could help restructure a bit. Cogswell said they appreciated our flexibility, but really needed more.

Cogswell wanted to move more payments from the upfront to the earn out, since they worried we would leave and not deliver. We were worried that if they did not trust us, it would be hard to succeed… and if they were so worried about the upfront payments, perhaps they did not intend to pay out the future payments.

We were losing trust. We said no.

They couldn’t get the deal done the way it was.

The End

Within a few days we had a call and agreed that it was over. Cogswell paid out the breakup fee—which covered the cost of the legal and accounting bills associated with the process.

We called Spacely. Our contacts there were really unhappy. They wanted to do the deal, but in the months since we went silent, they had put themselves into a position where they could no longer do anything in the space.

The process was officially done. I sent an email to our shareholders.

We were roughly back to where we were six months earlier.

Going Forward

Right when things ended, we had moments of feeling:

- Bummed we spent so much time on this; distracted from building our business.

- Confused a bit about “what next” since we planned to scale and integrate.

- Unsure whether we had made the right decision in walking away from the deal.

However, we took a step back and thought it about it some more:

-

- Backblaze is profitable and cash flow positive. We can continue building.

- The time spent on the deal had some value. We prepared for hyper growth to support millions of new customers. Thus, now it is easier for us to grow our own business.

- We had automated and systematized a number of data center and tech support areas preparing for hyper growth—making it easier to handle our current growth.

- We have a service that customers love.

Not so bad.

So, we all regrouped and refocused on our roadmap and growing the business. Since then we have hired two people to enable us to move faster, racked our 100th Storage Pod, shipped a few minor and one major release, and are actively working on some other good stuff.

Lessons Learned

I feel like I took so many lessons from this that I couldn’t possibly capture them in one blog post, but let me start with a few:

-

-

- 1. Build trust—it’s job #1.

-

Spreadsheet models can show anything. Due diligence can overlook things. Commitments can be lawyer’ed out of. Ultimately, the difference between success and failure of a merger is whether the teams trust each other. Start early. Partner. Meet live. Talk to references. Do whatever it takes to make sure both sides trust each other. If either side doesn’t, no amount of legalese in a contract will help.

-

-

- 2. Getting acquired is expensive.

-

In our previous companies, the process cost hundreds of thousands of dollars in legal fees alone. We worked with our lawyers to offload as much of the work to us as possible and use them only when critical. This helped a great deal. It was still very expensive. Consider whether you can “afford to be acquired” and look at getting a breakup fee and/or working out a deal with your lawyers just in case.

-

-

- 3. Find great advisors.

-

I cannot overstate the value of our advisors—our lawyers, our accountants, and our business advisors. We did not hire bankers. They sometimes make sense. But advisors help with contacts, getting perspective when you are really deep in the process, understanding what is common in the market, background references, and more.

-

-

- 4. Know your wants and walkaways up front.

-

Unless you’re desperate, you probably do not just want to be acquired. What do you consider being fairly compensated for the company you have built? Do you want to stay and run the company or does everyone want to sell the technology and leave? Where will you be physically located? Will you be able to continue executing on your vision or will the technology simply be repurposed? What about your existing customers and partners? Figure out what is important to the team up front and write it down—it’s easier to stay true to it throughout the process and for the internal decisions to be less emotional.

-

-

- 5. Require quick movement.

-

Deals have a flow and when they stretch too long, people get “deal fatigue.” We sell one core service, have fairly few employees, no VC funding, no complicated contracts, and are generally a very simple company to understand. If a deal is taking months to execute on, this is suboptimal for both parties. If two companies want a deal to happen—push for it to happen quickly. Get people in rooms. Ensure the decisions makers are there. Set short deadlines. Don’t let the deal stretch out into multiple months.

Feel free to Tweet, Facebook, or email me questions. While I’m finally leaving in a few days on the honeymoon that got put off for this process, I’ll try to answer as many as I can before I leave and group common questions together and share thoughts back on our blog when I return.